23 Mayıs 2025

What is SGDP (Social Security Support Contribution)?

In modern working life, the concept of retirement no longer necessarily signifies a complete withdrawal from professional life. Various factors such as economic conditions, professional commitment, and the sustainability of a skilled workforce lead many individuals to re-enter working life after retirement. At this point, the Social Security Support Contribution (SGDP) emerges as a practice that must be carefully considered by employers in terms of both legal obligations and cost planning.

The SGDP system enables individuals who are receiving a retirement pension to contribute again to the social security system when they resume working, while also allowing them to continue productive activity without suspension of their retirement pension. However, this system differs from the standard insured employment structure, and many aspects of its implementation may give rise to serious legal and financial issues if misunderstood. In this article, the nature of SGDP, the persons it covers, the current contribution rates for 2026, and key implementation details will be addressed.

What is SGDP?

The Social Security Support Contribution (SGDP) is a contribution collected from employers when a retired individual works under an employment contract without suspension of their pension. Individuals who have been granted a retirement pension are, in cases where they continue working or return to working life, evaluated within the scope of SGDP rather than standard insured employment. In this way, retirement pensions are not suspended, while employers are able to benefit from an experienced workforce at lower contribution rates.

SGDP is a type of insurance arrangement that is subject to certain limitations for both employees and employers. Unlike full insured status, it does not provide coverage under long-term insurance branches, unemployment insurance contributions, or entitlement to a second retirement. However, it ensures that the employee continues to benefit from healthcare services and remains protected against work accidents and occupational accidents. In this respect, the system enables retirees to maintain their productivity while continuing to benefit from social security protection.

Legal Basis of SGDP

Regulations regarding SGDP are set out in Article 30 and Provisional Article 14 of Law No. 5510 on Social Insurance and General Health Insurance. According to these provisions, where individuals who have been granted an old-age pension start working under an employment contract (within the scope of Article 4/a), their pensions are not suspended; however, SGDP is payable by the employer in respect of such individuals.

At the corporate level, particularly for human resources and payroll departments, the application of SGDP gives rise to accounting and reporting differences between standard insured employees and employees covered by SGDP. The withholding and premium service declaration for insured persons employed subject to SGDP must be submitted using “Document Type No. 2: Employees Subject to Social Security Support Contribution.” Since unemployment insurance contributions and long-term insurance branches are not paid for personnel covered by SGDP, transactions must be processed using the correct insurance codes within the payroll system. Otherwise, issues such as retroactive administrative penalties, incorrect contribution accruals, or the erroneous suspension of retirement pensions may be encountered during Social Security Institution (SSI) audits.

2026 Social Security Support Contribution (SGDP) Rates

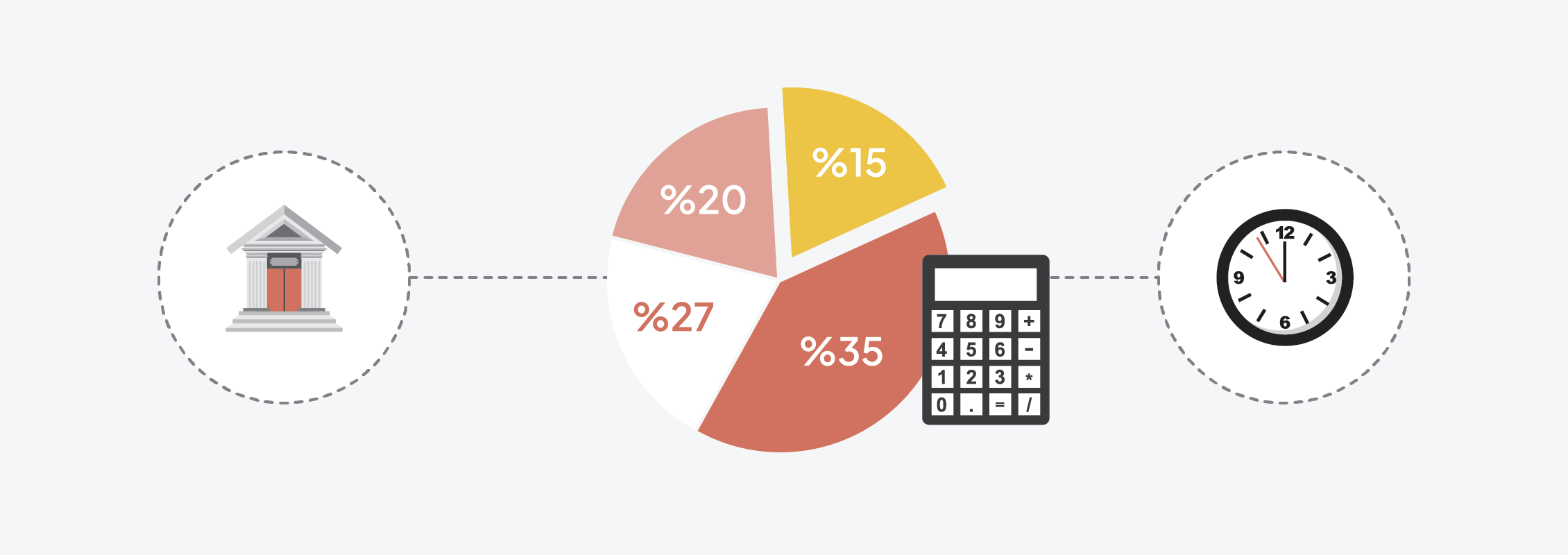

As of 2026, the SGDP contribution rates in effect are structured as follows:

- Employee (Retiree) Share: 7.5%

- Employer Share: 22.5%

- Short-Term Insurance Branches Premium (Employer Share): 2.25%

- Total SGDP Rate: 32.25%

These rates apply only to retirees employed under Article 4/a (SSK). Applications differ for those working within the scope of Article 4/c (Pension Fund). For example, if an individual who retired under Article 4/c returns to a public duty, SGDP is not applied; instead, the retirement pension is suspended and full insured status commences.

Who Pays the Social Security Support Contribution (SGDP)?

Unlike the standard insured contribution system, SGDP creates a more limited scope of obligations for both the employer and the employee. While the retired employee pays a 7.5% contribution calculated on the gross salary, the employer pays SGDP at a rate of 24.75% calculated on the same salary. The employee’s share is shown on the payroll and deducted from the salary, whereas the employer’s share is added to the employer’s cost.

Is the Pension of Individuals Who Work After Retirement Suspended?

Whether a retirement pension is suspended when an individual resumes working after retirement varies depending on the date on which the individual was first insured. This distinction is made based on October 2008, the date on which Law No. 5510 on Social Insurance and General Health Insurance entered into force.

Individuals with Insurance Commencement Prior to October 2008

- as insured persons subject to SGDP,

- using the correct document type and legal code,

- in a timely manner.

Individuals with Insurance Commencement After October 2008

- The old-age pensions of post-October 2008 retirees working under Article 4/a (employees) and Article 4/c (civil servants) are suspended.

- For those working under Article 4/b (Bağ-Kur) status, since SGDP is not applicable, the old-age pensions of individuals working within this scope are not suspended.

Individuals who were first insured before October 2008, as well as those who have been granted a disability or old-age pension, may continue working after retirement by paying the Social Security Support Contribution (SGDP). Within this scope, the retirement pensions of such employees are not suspended.

However, the most critical issue to be considered in this context is the employer’s reporting obligation. Retired employees must be reported to the Social Security Institution (SSI);

Otherwise, SSI audits may result in consequences such as the suspension of the retirement pension, retroactive contribution differences, cancellation of incentives, and administrative monetary penalties.

As a general rule, for individuals who were first insured after October 2008, when Law No. 5510 entered into force, and who have been granted an old-age pension by fulfilling the retirement conditions, the retirement pension is suspended if they resume working. The suspension of the pension is applied as of the beginning of the payment period following the date on which employment commences.

There is a limited exception to this rule. Individuals who are self-employed in agricultural activities on their own behalf and account may continue to receive their old-age pensions even if they continue working after retirement.

When assessed on a status basis;

In corporate companies, employees subject to SGDP must be reported separately, tracked distinctly within payroll systems, and declared through the monthly Withholding and Social Security Contribution Service Declaration. It should be borne in mind that, unlike fully insured employees, an employee under SGDP status is not subject to unemployment insurance contributions and does not accrue long-term pension entitlements.

From Whom Is SGDP Not Deducted?

The Social Security Support Contribution (SGDP) does not apply to every retired employee. Under SSI legislation, it is possible in certain cases to continue working without suspension of the retirement pension, and SGDP is not collected from such individuals. These exceptions are based on specific criteria such as the nature of work, sector, and international legislation. As of 2025, SGDP is not deducted in the following cases:

- Retirees who are self-employed in agricultural activities on their own behalf and account (those who continue agricultural activities through a sole proprietorship after retirement),

- Retired employees who are sent abroad by Turkish employers to work in countries with which Türkiye does not have a social security agreement,

- Individuals appointed to exceptional positions in public institutions outside the scope of Law No. 5335 (such as lecturer positions),

- Public officials who are reported as insured employees because it is not possible for them to work in public institutions without suspension of their retirement pension (these individuals pay full contributions, not SGDP).

Note: Since the individuals listed above do not fall within the scope of SGDP, either their retirement pensions continue without interruption or they are evaluated under full insured status.

How is SGDP Calculated?

The SGDP calculation process is carried out through the following steps:

- Determination of Gross Salary: The employee's gross salary is identified.

- Employee SGDP Deduction (7.5%): Calculated based on the gross salary and deducted from the employee's wage.

- Employer SGDP Share (22.5%): Calculated on the gross salary and paid by the employer to the Social Security Institution (SSI).

- Short-Term Insurance Branches Contribution (2.25%): Calculated on the gross salary and paid by the employer.

- Total SGDP Amount: The sum of the employee’s and employer’s shares.

- Calculation of Net Salary: The net salary is determined by deducting the employee SGDP contribution and other statutory deductions from the gross salary.

Calculation of SGDP Contribution and Employer Cost for a Retired Employee Working at the Minimum Wage (2026)

In the event that a retired employee works under the scope of SGDP, the employer cost in 2026 is determined as follows:

| Item | Amount (TRY) |

|---|---|

| Gross Salary | 33,030.00 |

| SGDP Employee Share (7,5%) | 2,477.25 |

| Income Tax Base | 30,552.75 |

| Income Tax Amount (15%) | 4,582.91 |

| Income Tax Exemption | 4,211.33 |

| Income Tax Payable | 371.58 |

| Stamp Duty Exemption | 250.70 |

| Stamp Duty Payable | 0 |

| Total Deductions | 2,848.83 |

| Monthly Net Salary (Gross − Employee SGDP − Income Tax) | 30,181.17 |

| Employer Contributions | 8,174.93 |

| SGDP Employer Share (22.5%) | 7,431.75 |

| • Short-Term Insurance Branches Contribution (Work Accident/Occupational Disease / 2.25%): | 743.18 |

| Total Employer Cost (Gross Salary + Employer Contributions) | 41,204.93 |

Rights of Retirees Working under SGDP

Retirees working within the scope of SGDP do not have the same social security rights as fully insured employees. However, they continue to benefit from certain fundamental rights:

- Rights They Can Benefit From:

- General health insurance coverage (examinations, treatment, medication),

- Temporary incapacity allowance in cases of work accidents and occupational diseases.

- Rights They Cannot Benefit From:

- The number of contribution days for old-age, disability, or survivors’ insurance does not increase,

- Payment of SGDP does not create entitlement to a second retirement,

- Unemployment benefits cannot be received since unemployment insurance contributions are not paid,

- Incapacity allowance is not paid due to illness or maternity.

Notification!