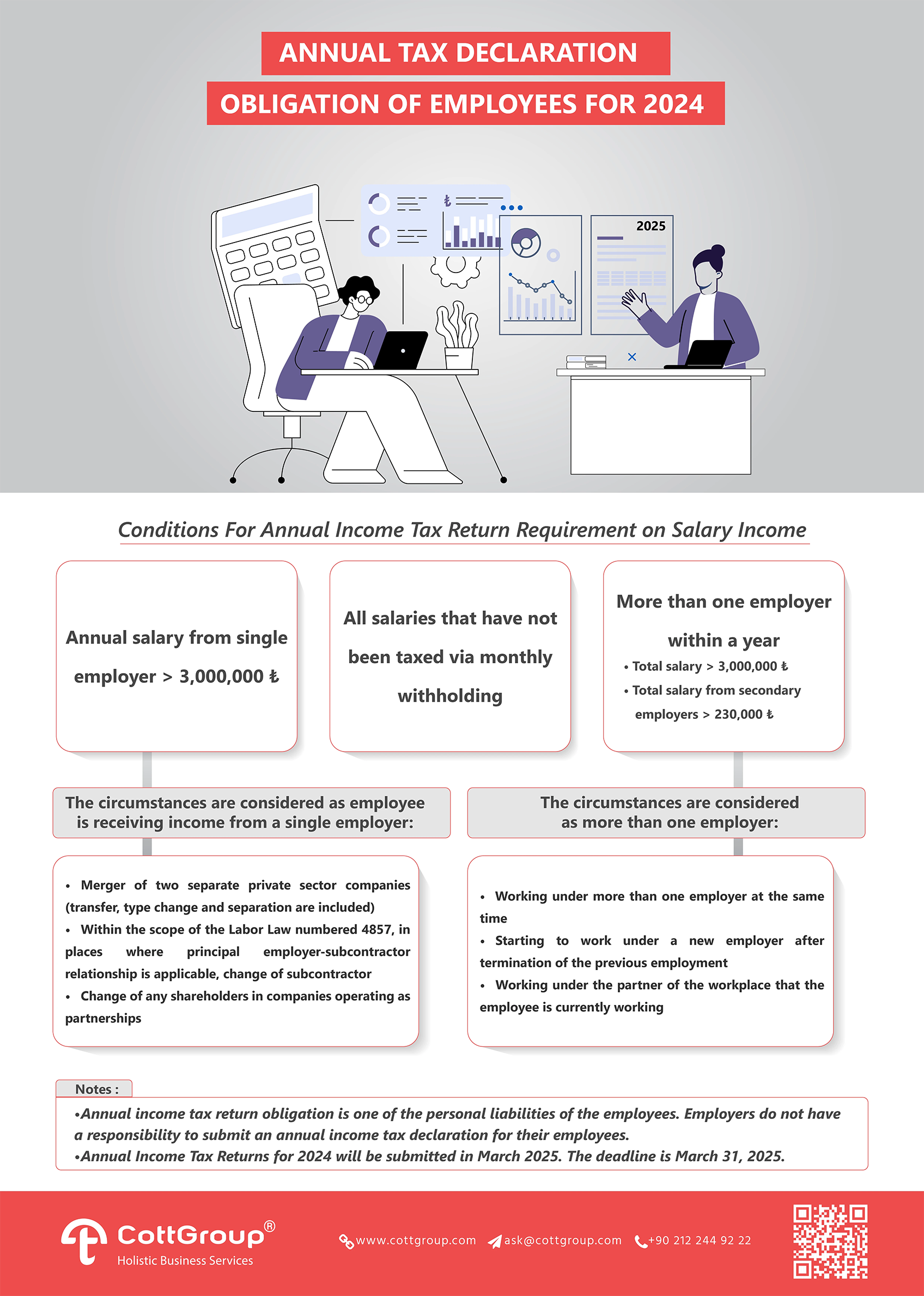

Annual Tax Declaration Obligation of Employees for 2024

According to the general communiqué no: 311 which has been published by the Revenue Administration Directorate, explanations regarding taxation of salaries are as follows:

Taxation and declaration of salary income received from single or multiple employers

Taxed by stoppage;