Withholding and Premium Service Declaration

Withholding and Premium Service Declaration

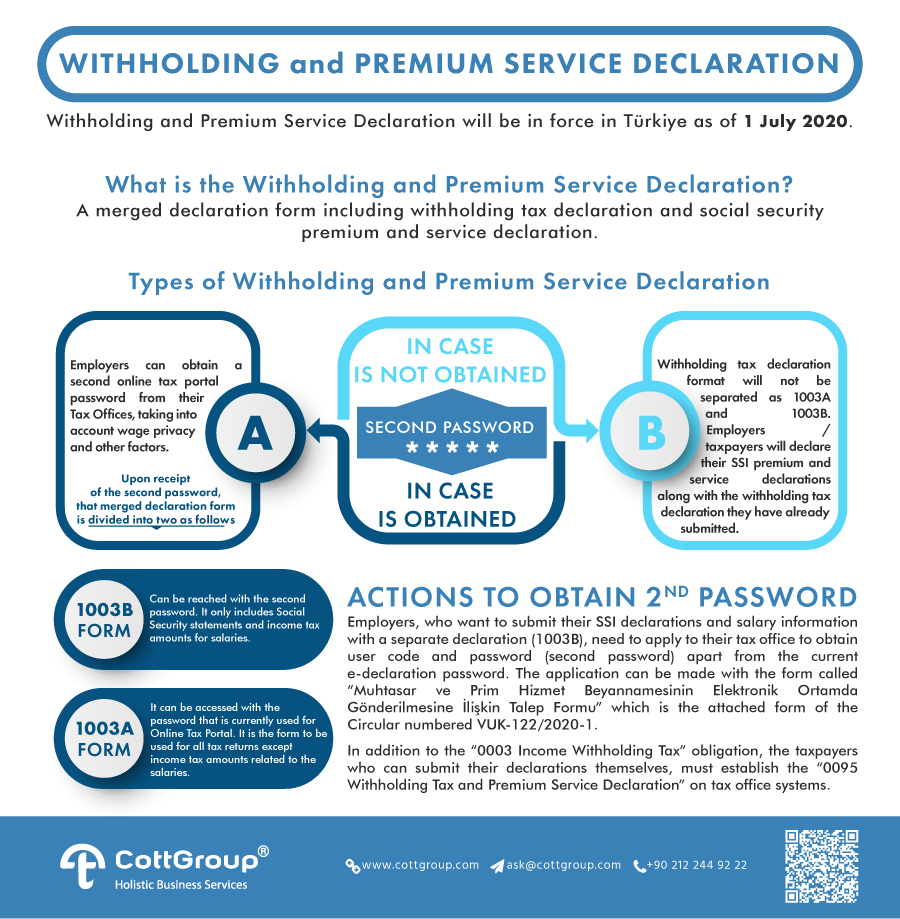

Withholding and Premium Service Declaration will be in force in Türkiye as of 1 July 2020.

What is the Withholding and Premium Service Declaration

A merged declaration form including withholding tax declaration and social security premium and service declaration.

Types of Withholding and Premium Service Declaration

- In case a second password is obtained

- FORM 1003B

- FORM 1003A

- In case a second password is not obtained

Employers can obtain a second online tax portal password from their Tax Offices, taking into account wage privacy and other factors.

Upon receipt of the second password, that merged declaration form is divided into two as follows:

Can be reached with the second password.

It only includes Social Security statements and income tax amounts for salaries.

It can be accessed with the password that is currently used for Online Tax Portal.

It is the form to be used for all tax returns except income tax amounts related to the salaries.

Withholding tax declaration format will not be separated as 1003A and 1003B.

Employers / taxpayers will declare their SSI premium and service declarations along with the withholding tax declaration they have already submitted.

Actions To Obtain 2nd Password

Employers, who want to submit their SSI declarations and salary information with a separate declaration (1003B), need to apply to their tax office to obtain user code and password (second password) apart from the current e-declaration password. The application can be made with the form called "Muhtasar ve Prim Hizmet Beyannamesinin Elektronik Ortamda Gönderilmesine İlişkin Talep Formu" which is the attached form of the Circular numbered VUK-122/2020-1.

In addition to the "0003 Income Withholding Tax" obligation, the taxpayers who can submit their declarations themselves, must establish the "0095 Withholding Tax and Premium Service Declaration" on tax office systems.

For detailed information, you can read the Withholding and Premium Service Declaration Editing Guide.