The Declaration of the Remote Workdays

As you know, the remote workdays within a month would need to be declared to Social Security Institution per their General Letter published on 02.06.2021.

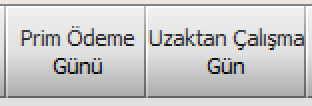

Based on this, it has been created a new column on the format of the merged Income Tax and Social Security Premium Declaration file as below:

On the General Letter, SSI states that the remote workdays should not be more than the actual workdays within the month. Accordingly, the actual remote workdays would need to be declared under the new column on the declaration file.

For example,

If an employee has 30 workdays in total within a month and 20 days of these workdays are remote workdays, the total social security premium days should be 30, and remote workdays should be 20 on the declaration file.

If an employee has 20 workdays in total within a month and 10 days of these workdays are remote workdays, the total social security premium days should be 20 and remote workdays should be 10 on the declaration file.

If an employee has 10 workdays in total within a month and 10 days as remote workdays, the total social security premium days should be 10 and remote workdays should be 10 on the declaration file.

As is it understood, the declaration of the remote workdays would not have any effects on the social security premium days, premium calculation, or net payment of the employees. This would be considered as additional information to be given to the authorities.

Based on this;

- The declaration preparation software would need to be updated per that recent change.

- The employers would need to track and record the remote workdays of the employees within the related month for the declaration.

- These remote workdays would need to be declared under the recently created column for remote workdays on the merged Income Tax and Social Security Premium Declaration file.

- On the Letter of SSI, there is no specific scope stated for this rule and accordingly, this rule would be applicable for all remote workdays.

- If there is no remote workdays within the related month, you can leave this part as blank and complete the declaration.

You can reach the details about the General Letter of SSI via the link.

You can reach the details of the Remote Work Regulation via that link.

You can reach the details of the Technical Measures to Consider During Remote Working via that link.

Should you have any queries or need further details, please contact your customer representative.

-

-

Notification!