Tax Map For Rent Income Earners

Each year, the rent income that individuals earn is declared through the Annual Income Declaration within March. The declarations for 2020 income should be submitted until March 31, 2021. The types of income that are within the scope of GMSI except for the rental income, are stated in the Income Tax Law Number 70.

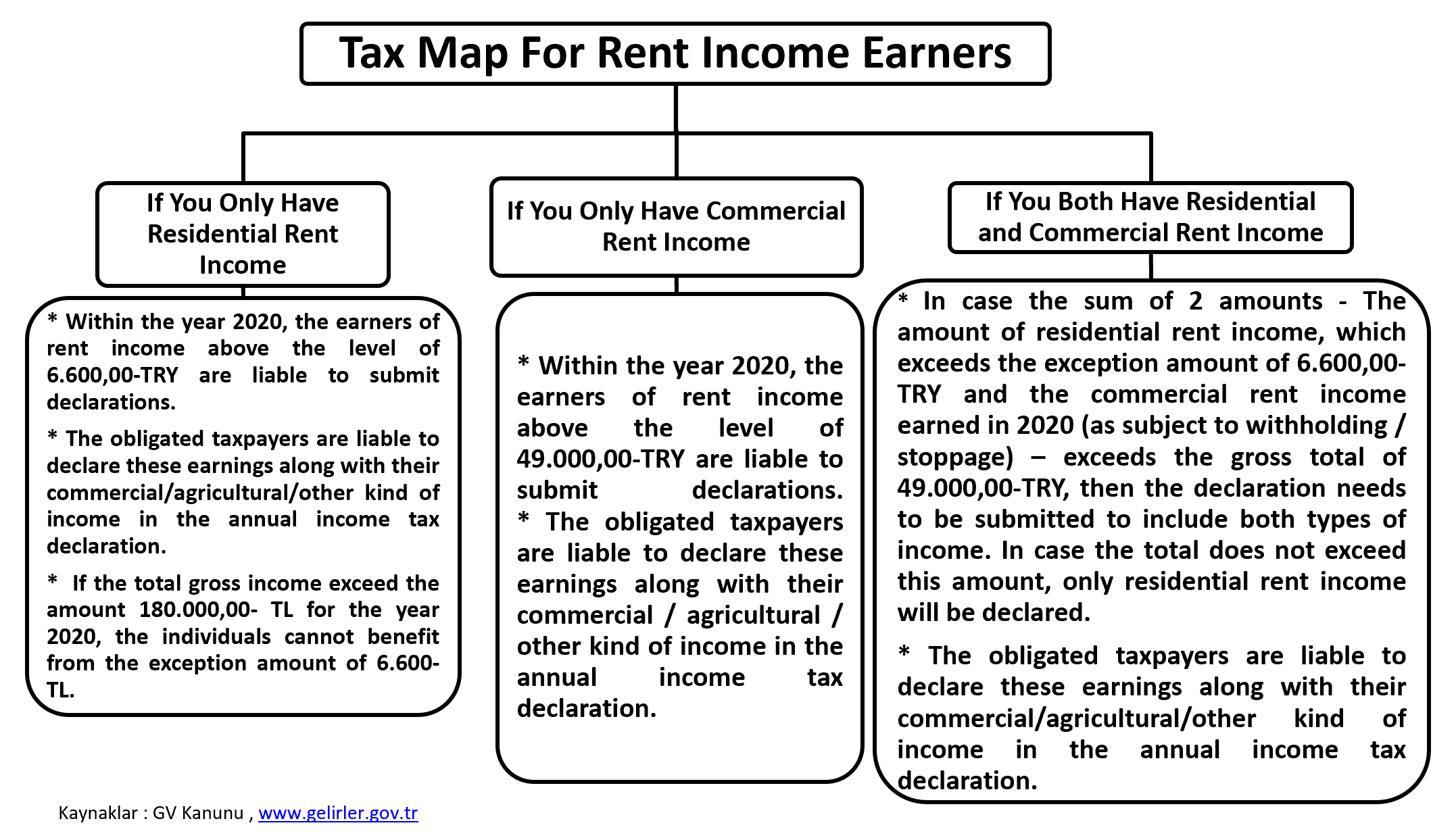

In order to declare the rental income, the lump sum expense method and real expense methods are implemented. After deducting the amount of exception from the rental income, 15% of the remaining amount can be deducted against actual expenses. Lump sum expense method is not applicable for lease of rights. Information is only provided for rental income from residental and commercial places in the table below. For further detailed information, please contact your customer representative or an expert.

-

Tax Map For Rent Income Earners - Archive

-

-

Notification!