Enhancements on the Requirements for Short-Employment Allowance

As you know, huge volume of activities have stopped in some sectors due to the coronavirus epidemic and employers have started to implement flexible work opportunities.

The employers can apply for short-employment allowance in case of these kind of situations.

Accordingly, the authorities have announced the below updates by adding a Temporary Article 23 to the Law No: 4447 for the purpose of enhancement on the requirements for short-employment allowance.

For the applications that would be applicable until 30 June 2020:

- Of those who have paid premium for the last 60 days and constantly worked before the commencement of short employment,

- those who have paid unemployment insurance premium for at least 450 days in the last three years).

If the above criteria are not met by the employees, they can also benefit from short-employment allowance under below circumstances:

- They can benefit for the remaining period from the last entitlement date for the unemployment rights to the end of short-employment

- And, that period should not be more than short-employment period.

You can find the Temporary Article 23 in Law no:4447 below:

For the short-employment applications made for the compelling reason originating from the new coronavirus (Covid-19), valid until 30/6/2020, excluding the termination of the service contract envisaged in the third paragraph of the additional article 2 for the worker to qualify for the short-time working allowance the provision to fulfill the conditions of entitlement to unemployment insurance, short working start date those who have been subjected to service contract for the last 60 days, have worked for 450 days insured in the last three years unemployment insurance premium is applied as paid. Those who do not meet this condition, with the period not exceed the short employment period can continue to benefit from the allowance for the time remaining from the last unemployment benefit entitlement.

In order to benefit from short work practice under this article, employees should not be dismissed by the employer, except for the reasons mentioned in the clause (II) of the first paragraph of Article 25 of the Law No. 4857 during the study period.

Applications made under this article are concluded within 60 days from the date of application.

The President is authorized to extend the application date made under this article until 31/12/2020 and to differentiate the days specified in the first paragraph.

Short Employment Allowance

The circumstances for short-employment opportunity have been located on Unemployment Insurance Law no: 4447, Article Add.2. These circumstances are as below:

- General economical, sectoral or regional crisis.

- Force major situations

With the above circumstances, employers can reduce the work hours temporarily or stop the activities completely. And, accordingly Turkish Employment Agency (İş-Kur) can make short-employment allowance to the employees.

General economic crisis represents the situations that have effects on national economy and the employers’ activities. These situations can due from national or international progresses.

Force Major represents the unpredictable situations like natural disasters, epidemics, military operation preparations that can cause temporary or permanents activity stops or reduce on the employers.

Accordingly, coronavirus epidemic can be considered as a reason for short-employment working.

Short-employment allowance can be applicable with the below circumstances not for more than 3 months (President can extend that period to 6 months):

- If the weekly working hours are reduced temporarily in a ratio of one third

- If the activities stopped fully or partly at least for four weeks.

The below steps should be followed for short-employment working application;

- The Employer should submit the Short Employment Request Form to Turkish Employment Agency.

- That application is evaluated by the Agency in terms of its reason and form.

In order for an employee to benefit from the short employment allowance;

- Short employment request of the employer should be approved by the Agency,

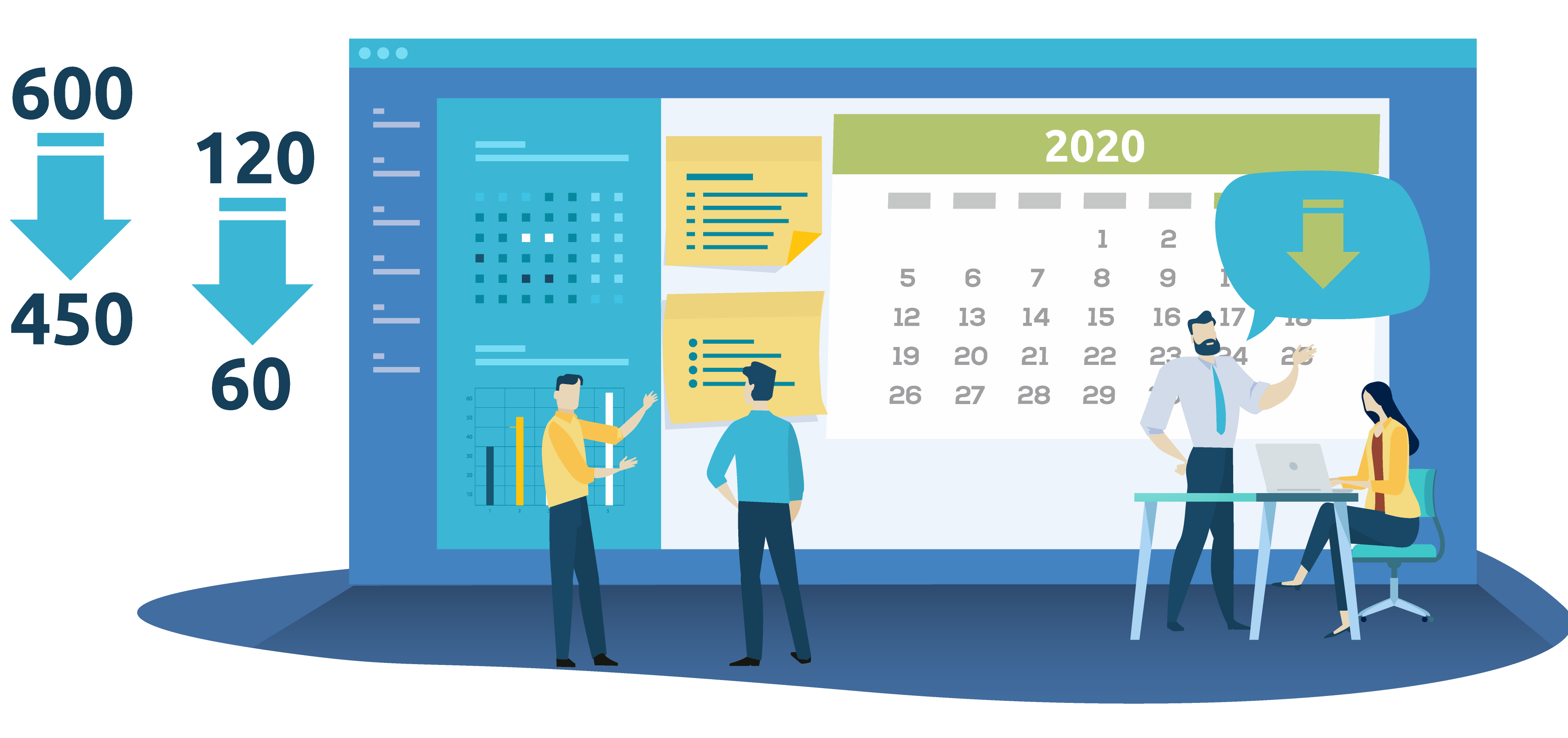

- In accordance with the Article 50 of the law no. 4447, employees should be entitled to unemployment allowance in terms of their employment period and the amount of days of unemployment insurance payment by the date of the commencement of short employment (Of those who have paid premium for the last 120 days and constantly worked before the commencement of short employment, those who have paid unemployment insurance premium for at least 600 days in the last three years).

The above criteria changed with the Temporary Article 23 on Law No: 4447 as below:

For the applications that would be applicable until 30 June 2020:

- Of those who have paid premium for the last 60 days and constantly worked before the commencement of short employment,

- Those who have paid unemployment insurance premium for at least 450 days in the last three years).

If the above criteria are not met by the employees, they can also benefit from short-employment allowance under below circumstances:

- They can benefit for the remaining period from the last entitlement date for the unemployment rights to the end of short-employment

- And, that period should not be more than short-employment period.

You can find the Temporary Article 23 in Law no:4447 below:

For the short-employment applications made for the compelling reason originating from the new coronavirus (Covid-19), valid until 30/6/2020, excluding the termination of the service contract envisaged in the third paragraph of the additional article 2 for the worker to qualify for the short-time working allowance the provision to fulfill the conditions of entitlement to unemployment insurance, short working start date those who have been subjected to service contract for the last 60 days, have worked for 450 days insured in the last three years unemployment insurance premium is applied as paid. Those who do not meet this condition, with the period not exceed the short employment period can continue to benefit from the allowance for the time remaining from the last unemployment benefit entitlement.

In order to benefit from short work practice under this article, employees should not be dismissed by the employer, except for the reasons mentioned in the clause (II) of the first paragraph of Article 25 of the Law No. 4857 during the study period.

Applications made under this article are concluded within 60 days from the date of application.

The President is authorized to extend the application date made under this article until 31/12/2020 and to differentiate the days specified in the first paragraph.

Short Employment Allowance Payment Amount

Amount of daily short employment allowance is 60% of daily gross average earning calculated by taking into consideration the earnings of the insurant for the last twelve months subject to premium, not exceeding 150% of the gross amount of monthly minimum wage for those older than 16 years of age in accordance with the article 39 of the Labor Law no. 4857 dated 22/5/2003. Short employment allowance is paid in accordance with the article 50 of the law no. 4447 as long as not violating the Supplementary article 2 of the same Law.

Period of short employment allowance is as long as the short employment period not more than 3 months.

Short employment allowance is calculated monthly for periods of unemployment as covering the weekly working time in a workplace.

Short employment allowance is paid over the de-facto duration of short employment on the condition that it shall not exceed the time specified in the assessment of conformity in accordance with the effects of economic developments on the operations of the workplace.

In case of short employment in the workplace due to forces majeure, payments begin after the one-week period provided in the item (III) of the article 24, and in the article 40 of the Law no. 4857.

If an employee who benefits from the short employment allowance is made redundant without the conditions provided in the article 50 of the Law no. 4447 being realized, they benefit from the unemployment allowance until they complete the period of the unemployment allowance they were formerly entitled to, after the deduction of short employment allowance.

Short employment allowance is paid to the employee as a wage at the end of each month.

Short employment allowance cannot be transferred or assigned to another person apart except subsistence debts.

Overpayments made due to false information or document of are collected with their legal rate of interest from the employer in case of employer’s fault, and from the employee in case of employee’s fault.

You can find the application documents and the related e-mail address list to be used for the applications:

-

-

Notification!