18 March 2022

Reasons for Differences in Calculation of Social Security Institution (SSI) Incentives

What is Social Security?

As a social being, the humankind seeks for social security throughout their life. Security is the one of the principal fundamental rights. According to the Article 60 of the constitution, “Everyone has the right to social security. The State shall take the necessary measures and establish the organization for the provision of social security.” Social security is the term for assuring the conditions for one to live by themselves without needing the help of another human being when they experience loss in the face of occupational or social risks. The Social Security institution was built for actively executing this mission. The institution was formed to provide and maintain social security as a result of the important regulations made on the Social Security Institution Law No. 5502 and the Social Insurance and General Health Insurance Law No. 5510.

What do we understand from the SSI Incentives?

Incentive is the term for indicating the public support due to the rapid development and effectiveness of various economic and social activities compared to different fields.

The reason for the SSI incentives is the need for generating income for the social security system to work more functionally, fairly and in line with people's needs. Employment increase must be a r supported in order to generate and sustain this income. At the same time, social security premium incentives are an important element for preventing unregistered employment. In short, the aforementioned incentives serve to the following purposes:

- Increasing the employment rate of registered employees,

- Ensuring the participation of women, youth, the disabled and various disadvantaged groups in business life,

- Supporting regional and strategic investments,

- Reducing regional development disparities.

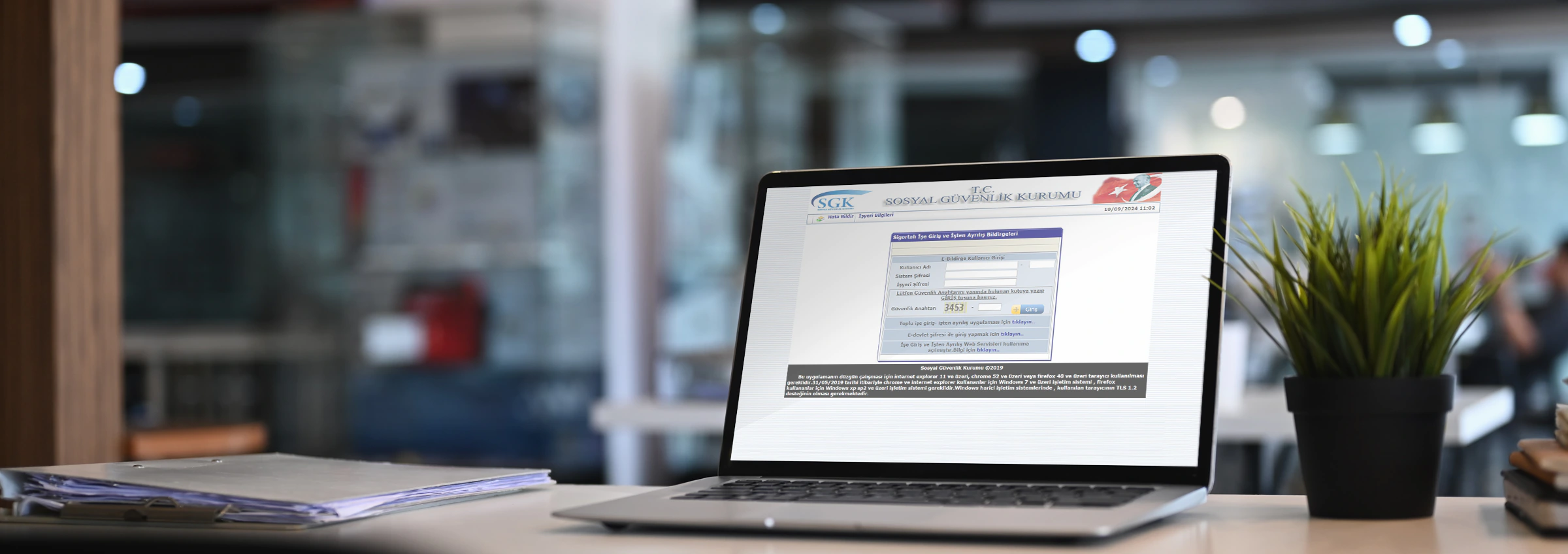

Calculation Difficulties of Insurance Premium Incentives

Diversity of Incentives

Incentives are calculated by considering criteria such as the number of employees, average number of employees, timely payment of premiums, having no premium debt, age, gender, retirement status. Although we generally refer to the incentives as SSI premium incentives, these supports, and discounts are regulated by different laws. In addition, the number of incentives provided varies according to periods and some incentives are removed from the application. Even it changes depending on the period of the year, there are almost twenty support and discount incentives. These incentives are as below: (We would like to remind you that these incentives may not be up-to-date and periodic at the time you review our article.)

- Incentives within the scope of Social Insurance and General Health Insurance Law No. 5510 (click for information about debt inquiry)

- Incentives under the Unemployment Insurance Law No. 4447

- Incentives under the Labor Law No. 4857

- Incentives within the scope of Law No. 5746 on Supporting Research, Development and Design Activities

- Incentives within the scope of the Cultural Investments and Initiatives Encouragement Law No. 5225

- Incentives under the Social Services Law No. 2828 (Temporary Article Due to Covid-19)

- Incentives within the scope of Social Assistance and Solidarity Encouragement Law No. 3294

- Incentives within the scope of the Occupational Health and Safety Law No. 6331

- Law No. 6111 Premium Support (extended until 31.12.2022)

- Law No. 27256 Surplus Employment Premium Support (4447/Provisional 28th Art.) (ended)

- Incentives Under the Law No. 7252 (ended)

- Incentives calculated in accordance with the temporary Article No. 30 added to the Unemployment Insurance Law No. 4447 with the Bag Law No. 7316 (ended)

Differences in Calculation

It is almost impossible to calculate the terms of us efor incentives without an incentive software since this process requires knowledge and expertise. In general, software's of various vendors with complex algorithms calculates with the maximum revenue-generating exploit algorithm. These calculation results are also taken into account in the payroll processing software, and the discounted premium amounts are reflected in the declaration. Advanced Incentive Management systems are designed to maximize the amount of discount to be used. The most important aspect of this procedure is to ensure that the company won’t be in risk while preparing the best incentive combination. In some cases, it may be legally impossible to take advantage of an incentive if it conflicts with another. The risks of changes in the company's retrospective staff numbers must be taken into account (such as late notification of the employee). In summary, the employee turnover rate of the relevant company, the consistency of its records and the discipline of the declaration plays an important role. Under these circumstances, the company may be subject to a penalty only when they target the highest discounts. Taking the complex parameters and calculation rules into consideration, an organized risk management and optimum calculation setup should be implemented. In other words, focusing on high incentive returns can lead to unexpected losses and costs, as it is likely to be unfairly exploited. In order to prevent the losses; structure of the company, calculation criterions for the present period and alternate scenarios must be taken into account.

When the provider of the incentive calculation software is changed, there may be conflicts between two systems regarding the calculations. The information mentioned above is the reason of this situation. In other words, it is a preference for an incentive that has a high risk of benefiting but a relatively low return. Another reason for the differences in the calculations is because the calculations are generally made by taking the SSI assessments into account. However, the law regarding the type of incentive applied may take into account a certain maximum fee. Finally, a frequently encountered situation is the differences in the XML file that the company receives from its own system. These differences may occur in the current month as well as retrospectively. Retrospective adjustments, penalized entry information, changing day and premium information may affect the calculations. Finally, it is mentioned in the Law No. 6111 that while calculating the current month's incentive income of a firm with subcontractors, the total number of subcontractors is important. If the subcontractors have not yet uploaded and approved the premium service documents, then undercalculation will be inevitable. If the same calculation is made following the approval of the declarations, it is likely that there will be differences between the periods.

Should you have any queries or need further details, please contact your customer representative.

Notification!